A Pro-Growth Framework for Responsible Spending, Surplus-Driven Tax Relief, and Long-Term Prosperity

Introduction

South Carolina enters Fiscal Year 2027 with strong economic momentum but growing fiscal risk. Payroll employment expanded by 3.1 percent year over year, while the unemployment rate edged up to 4.3 percent in August 2025, according to the U.S. Bureau of Labor Statistics. The labor market remains among the most dynamic in the Southeast, supported by migration inflows and diversified job growth in professional services, health care, and hospitality, as detailed in the Richmond Fed’s South Carolina Economic Snapshot.

Behind this strength, however, the state budget tells a different story. Over the past decade, recurring spending has outpaced population growth plus inflation. The Americans for Tax Reform’s Sustainable Budget Project estimates that in 2024, South Carolina’s state-fund expenditures exceeded population growth plus inflation by $6.8 billion and all-fund spending by $9.9 billion—nearly $36 billion in cumulative overspending since 2015.

This report outlines the FY 2027 South Carolina Responsible Budget (SCRB): a framework combining a Responsible Spending Limit (RSL) tied to less than population growth plus inflation and a surplus-trigger buydown that automatically channels certified surpluses into lowering personal income taxes. Drawing from SCPC’s Path to Prosperity roadmap, ATR’s Sustainable Budget Project, and Club for Growth Foundation’s analysis in the Sustainable Budgeting Blueprint, the SCRB presents a credible path to eliminating South Carolina’s income tax.

Polling by the South Carolina Policy Council shows that 74 percent of voters support income-tax elimination and 68 percent favor a spending cap based on population growth plus inflation. Both of these policy positions have majority support among Republicans, Democrats , and Independents. The economic conditions, public mandate, and policy tools now align. The South Carolina Responsible Budget provides the blueprint to translate this moment into lasting prosperity.

I. South Carolina at a Fiscal Inflection Point

South Carolina’s economy remains one of the Southeast’s bright spots. Employment has expanded across key sectors such as business services, leisure and hospitality, and professional services, according to the Richmond Fed. Yet the state’s unemployment rate—at 4.3 percent—is up from 3.5 percent a year ago, signaling a modest cooling after years of rapid growth. Labor-force participation continues to climb, indicating that South Carolinians remain engaged in the job market even as it normalizes.

Economic output has also strengthened. The state’s real GDP grew at an annualized pace of 3.4 percent in the second quarter of 2025, led by gains in manufacturing, finance and insurance, and real estate and rental and leasing. Rising wages and continued population inflows have supported personal income growth above 6 percent, among the fastest in the country.

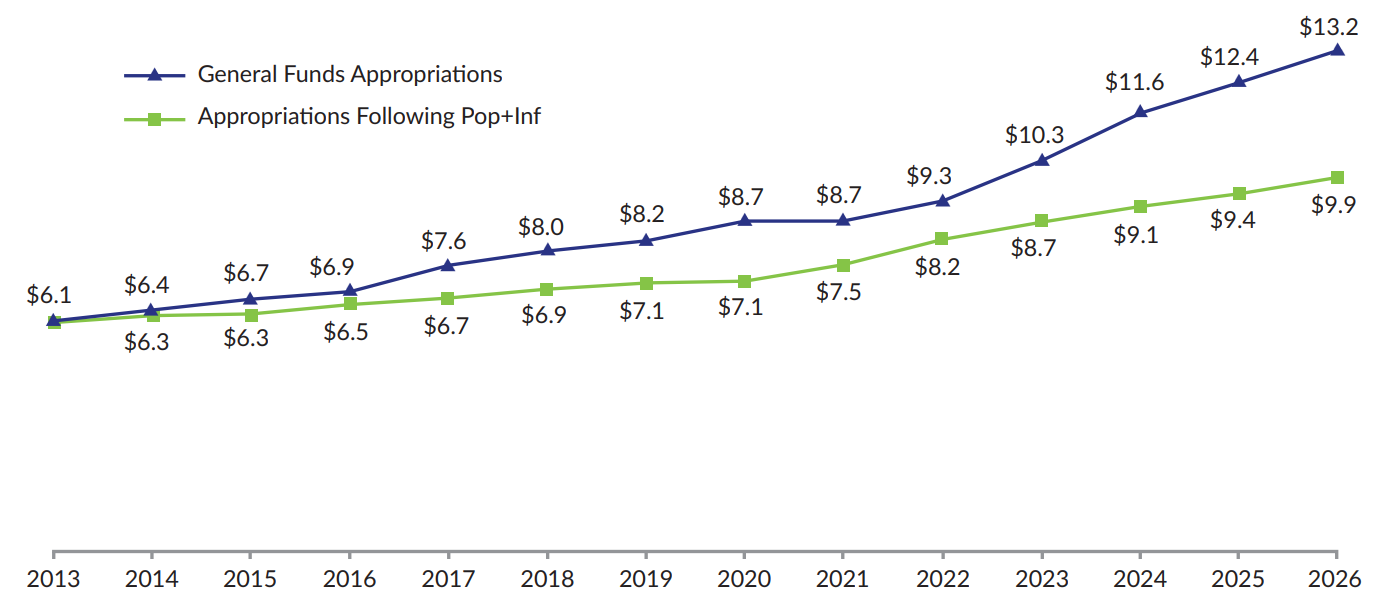

Despite these positive trends, fiscal policy has not kept pace with economic prudence. Figure 1 illustrates how General Fund appropriations have more than doubled since 2013—an increase of roughly 118 percent—while population growth plus inflation grew only 62 percent. The result is a structural imbalance: the government expanding faster than the average taxpayer’s ability to sustain it.

Figure 1: South Carolina General Fund Appropriations v. SCRB

14-year GF appropriations: $124.2 billion (117.6%)

14-year GF appropriations with population + inflation: $105.9 billion (+62.3%)

The South Carolina Policy Council’s 2025 Summer Poll found overwhelming backing for limiting government growth, improving transparency, and eliminating the personal income tax. Voters are ready for disciplined, transparent budgeting that prioritizes people over programs. The South Carolina Responsible Budget answers that call. It establishes a clear rule—government spending shall not grow faster than the average taxpayer’s capacity to fund it—and ties every tax cut to an actual, certified surplus. Evidence from other states shows that sustainable budgeting produces stronger growth, higher job creation, and improved fiscal stability.

By adopting this approach, South Carolina can transform record surpluses into a disciplined mechanism for long-term prosperity—eliminating the personal income tax within a decade, strengthening reserves, and ensuring that future growth serves taxpayers first.

Failure to put a cap into place comes at a cost. Had South Carolina adopted this spending framework after SCPC first published the initial SCRB in 2022, lawmakers would have saved $11.5 billion. This is enough to completely eliminate the income tax, bolster reserve funds and work towards reducing other tax burdens. Growing government spending yearly with no constraints results in a further delay in eliminating the income tax.

II. The Fiscal Landscape — Overspending, Surpluses, and Lost Opportunity

The combination of rising tax collections and rapid expenditure growth has produced recurring “surpluses” that are symptoms of over-collection, not evidence of restraint. South Carolina’s failure to enforce existing budget law requiring the state to abide by zero-based budgeting principles has contributed to this problem, as many state agencies do not justify their entire budget each year.

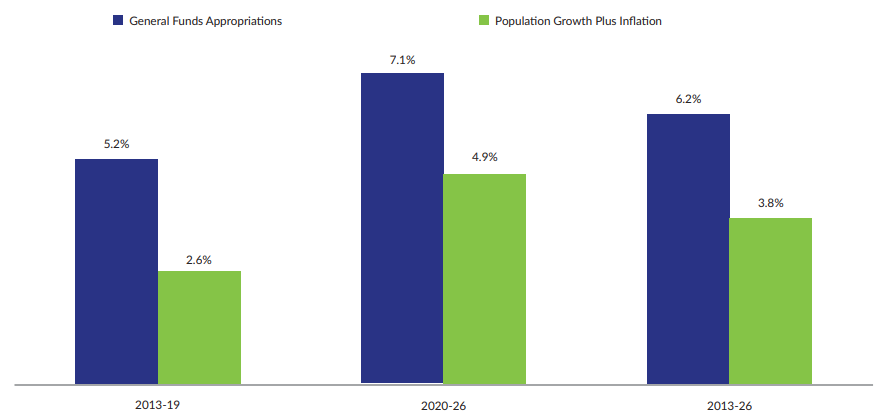

Figure 2 shows how General Fund spending has increased far faster than the combined growth of population and inflation over much of the last 14 years.

Figure 2: South Carolina General Fund Appropriations v. Population Growth Plus Inflation

According to the U.S. Bureau of Labor Statistics, South Carolina added roughly 72,000 nonfarm jobs over the past year through August 2025, an increase of about 3.1 percent—the fastest rate in the country. Employment gains remain broad-based, led by professional and business services, health care, and hospitality. Real GDP continues to grow at a solid pace, about 3.4 percent annualized in the second quarter of 2025, driven by construction, manufacturing, and professional services.

Americans for Tax Reform’s Sustainable Budget Project quantifies this imbalance with similar analysis: If South Carolina’s spending had been limited to population plus inflation from 2015 to 2024, FY 2024 outlays would have been $6.8 billion lower in state-fund accounts and $9.9 billion lower across all funds. Cumulative overspending equals $19.7 billion in state funds and $35.5 billion in all funds (state and federal funds), or about $14,300 to $25,950 per household of four.

Research from the Club for Growth Foundation provides a valuable benchmark: states that kept spending growth below population and inflation recorded faster real GDP growth, stronger job creation, and larger population gains than those that overspent. Applying that principle to South Carolina reveals the opportunity cost of the current trajectory.

III. A Responsible Budget Framework for South Carolina

The Responsible Spending Limit (RSL) caps recurring General Fund appropriations to the combined rate of population growth plus inflation, ensuring fiscal growth aligns with the average taxpayer’s capacity to pay.

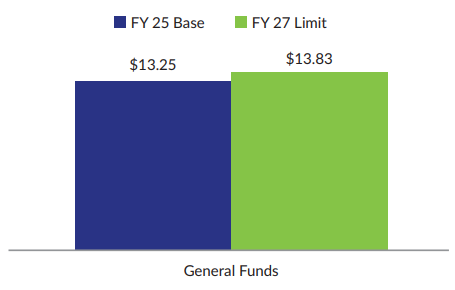

Figure 3 provides the Responsible South Carolina Budget limit for FY 2027 of 4.4% to $13.83 billion in General Fund spending. This growth limit is calculated based on estimated growth rates for 2025, the year before the legislative session when appropriations are made. This includes an estimated 1.8% increase in state population growth and 2.6% in U.S. chained-consumer price index inflation.

Figure 3: Responsible South Carolina Budget Limit for FY 2027

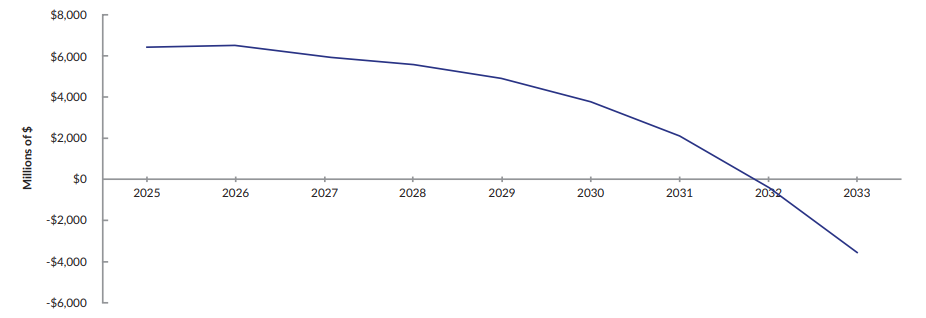

The Surplus-Trigger Buydown Fund dedicates actual surpluses to income-tax reductions, creating a self-correcting mechanism for sustainable relief. Under this approach, the Board of Economic Advisors and Comptroller General certify the RSL annually, publish results on a public dashboard, and oversee surplus allocation, such as 50 percent to rate reductions, 25 percent to reserves, and 25 percent to one-time liabilities. Applying a portion of the surplus towards reserves ensures that in the future if there were to be an economic downturn, the state would not have to reverse course on tax reform. Modeling by the South Carolina Policy Council indicates that dedicating 30 percent of surpluses could eliminate the personal income tax by FY 2032 and the corporate income tax by FY 2033. We have updated this analysis and found similar results in Figure 3.

Figure 3: Projected Surplus-Trigger Buydown Path to Zero Income Taxes

This framework provides a successful path forward by combining strict spending limits with predictable tax reform that drives economic growth.

IV. Fiscal Policy Design and Implementation Path

Implementation requires clear statutory rules, transparent certification, and a phased timeline:

- FY 2027–2029: Enact the RSL and surplus-trigger statutes, build reserves, and begin modest rate cuts.

• FY 2030–2032: Accelerate rate reductions, reach zero personal income tax.

• FY 2033 onward: Extend surplus triggers to corporate taxes and consider constitutional entrenchment.

Transparency and accountability reforms—such as livestreamed budget hearings, public earmark disclosure, and strict local property tax levy limits—will further strengthen fiscal credibility.

V. Economic and Policy Implications

States with sustainable budgets tend to outperform those that overspend. For South Carolina, this translates to faster increases in annual output, and the impact is even greater when considering compound growth over time. The surplus-trigger model is inherently countercyclical—it pauses cuts in downturns without reversing them. This stability prevents the budget volatility that plagued Kansas after its 2012 reforms and mirrors Colorado’s success under its Taxpayer’s Bill of Rights (TABOR). Adopting this approach outlined here would likely improve the Tax Foundation’s ranking of state tax competitiveness from 33rd to the top 15, aligning it with regional leaders like Florida and Tennessee while preserving fiscal stability.

VI. Conclusion and Policy Recommendations

The Responsible South Carolina Budget offers a research-based, pro-growth framework to restrain government, strengthen reserves, and eliminate the personal income tax within a decade.

Lawmakers should prioritize:

- Codifying the Responsible Spending Limit (RSL) tied to less than population growth plus inflation.

• Establishing the Surplus-Trigger Buydown Fund with an automatic allocation formula.

• Pairing tax reform with flat-rate simplicity and full expensing.

• Institutionalizing transparency through livestreaming , earmark disclosure, and enforcing zero based budgeting.

• Encouraging local governments to adopt parallel spending limits.

By following this blueprint, South Carolina can sustain economic momentum, improve its competitiveness, and demonstrate nationally that fiscal responsibility and prosperity go hand in hand.

Vance Ginn, Ph.D., is president of Ginn Economic Consulting, where he advises many free-market organizations, and was formerly the Associate Director for Economic Policy at the White House’s Office of Management and Budget (OMB). Sam Aaron is the Research Director at the South Carolina Policy Council.

The South Carolina Policy Council (SCPC), founded in 1986 by Thomas Roe, is the state's longest-serving free market research organization. It is an independent, nonpartisan group dedicated to promoting limited government, individual liberties, free markets, and traditional South Carolina values.