Greenville County Republican Party Planning to Censure the Republican County Councilmen Who Voted for the Recent Tax Increases

Michelle Shuman, a local taxpayer who lives in Greenville 1 Precinct, was a guest speaker at Greenville County Republican Party Executive Committee meeting on August 7th, 2023. She spoke on the county property tax situation that was affected by the recent tax increases voted by Greenville County Council.

Shuman has gotten a lot of attention for her in-depth and well-documented postings on social media platforms such as Facebook and Nextdoor about the Greenville County property tax increases and other issues with the finances and operations of the government of Greenville County.

She made it clear at the beginning of her speech that she is a child of God and made it very clear that she is totally out of her element as a public speaker. She has experience teaching preschoolers about God and His Word on Sunday which she expressed as her comfort zone.

She said that she is not technically a Greenville native but is as close to one as one can get without being one. She shared also that her husband is a born Greenville native, born in the old Greenville General Hospital. Her parents moved here in the mid-1960s when she was only 9 months old.

During her speech, you could literally hear members of the audience gasping with amazement and shock as she revealed her statistics surrounding the recent county tax increase and some of the facts regarding the financial operations of Greenville County government.

The following are the transcript and PowerPoint slides obtained by The Times Examiner from the speaker and her speech to the local upstate Republican activists who are clearly angry with the recent tax increases and have vowed to go after the Republican Council members who voted for the increases.

--------------------------

Speech by Michelle Shuman

I am going to give you a little bit of my life and work experience because it ties into some of what I am doing now with the County tax issue. You need to understand, I am just one of you. I am just a taxpayer seeking answers and frustrated with my government. I don’t have any special degrees or experience. My college and master’s degrees are in education.

After finishing my master’s degree, I moved to West Virginia for 5 years in the early 90’s to teach in a small Christian school near my grandparents. In the summers, I worked in a company’s accounting department where I quickly learned data entry skills and collections. Part of the collections’ duties involved research and problem-solving. I moved back hesre in the mid 90’s and haven’t left since. I worked in healthcare briefly then began working for a real estate developer and builder. Part of my responsibility there was again data entry and spreadsheets. In particular, I entered the information so that one of the owners could keep a close watch on the costs of each individual house. He literally nickeled and dimed each one, every single house. In addition, I helped with property management on some of the commercial properties including the office we were in which included moving it into a new space at one point. I’ve also worked for Nuvox Communications where I did audits of their commissions systems as well as other work in their commissions department. Later, I would work in the commercial real estate industry where I really picked up a lot more experience with leases, sale of commercial property, zoning, codes, etc. Eventually, I would end up working for a politician who is now no longer serving so now I can talk.

I bought my house in 2004 before my husband and I ever started dating. I had big dreams. It’s a cottage on a nice 1/3 acre. I wanted to make some changes. But the change in the property tax law changed all of that. If we made the changes I dreamed of, the reassessment would cause the taxes to skyrocket.

Early this past winter after we had paid off our home in the fall, my husband and I discussed that regrettably, we would never really own our home because of property taxes.

Another reality is if we were trying to buy a house today, the same house would be out of our price range.

When the Greenville County Council started talking about raising our property tax millage, I started thinking about the situation and what I knew about the laws and taxes. Ever since I started working in real estate for the first time, I’ve watched the real estate around me. I, like I’m sure many of you, questioned if the County isn’t getting additional taxes from reassessment and all the sales. So, I got up one Saturday morning and started researching my own street. I knew which houses had sold and even the ones that had been remodeled or had additions. That was the start of my research. All this information is based on public records. Anyone can easily access the information.

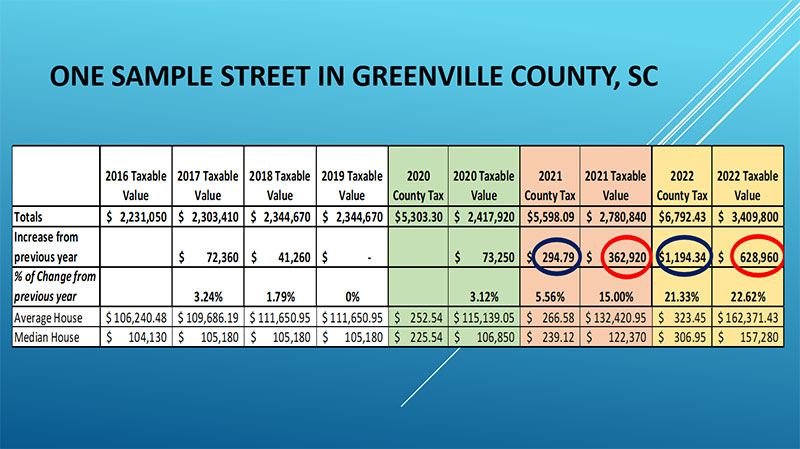

I did the taxable values back to 2016, but I could only see the last 3 years of tax bills online. I looked at the county tax line of the property tax bills only. In 2021, the County received an additional $294.79 in taxes over what it received in 2020. In 2022, the County received an additional $1,194.34 in taxes over what it received in 2021. The increases in taxable values were $73,250 for 2020 over 2019, $362,920 for 2021 over 2020, and $628,960 for 2022 over 2021. Most of these homes are owner-occupied and only two have undergone significant remodeling or additions. All other increases are either from sales or reassessment. So yes, reassessment, remodeling, and sales are making a difference in what our County gets.

I did this same exercise to see the difference in a newly developed subdivision near my home and I also looked at some new commercial properties and apartments compared to existing commercial properties and apartments. Every time the results showed that the County is getting more money from the reassessments, sales, developments, and remodeling.

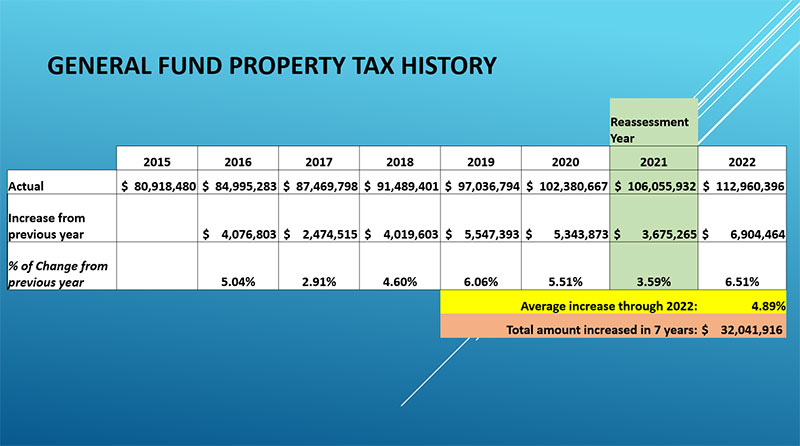

Another thing I looked at was the overall property tax revenues for the County back to 2015. The previous budgets are all online on the County’s website. I looked at property tax revenue only and not any other revenue source that the County has.

The County is increasing its property tax revenues every year on an average of 4.89%. Even in the reassessment year, the increase was 3.59%. In 2015, the County took in almost $81 million. In 2022, the County took in almost $113 million. So, in 2022 the County took in $32 million more than it did in 2015. During this time there has not been a millage increase yet the amount of money taken in has still increased every single year including the reassessment year.

This information took me to ask questions and learn more information. I discovered the SC Association of Counties website. This is a great resource of information. Among the wealth of information are definitions, tables, comparisons of the State’s counties, and opinions on issues. This was a great way to start checking the information that our county officials were giving us. Among the many reports on the website are reports for each year that give each county in the state and the different taxes and fees charged in each county. The most recent information they have is for 2022 so that is the numbers we will be using.

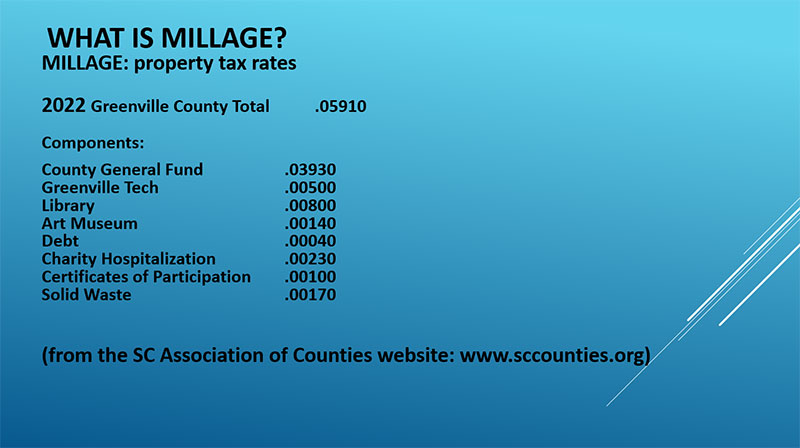

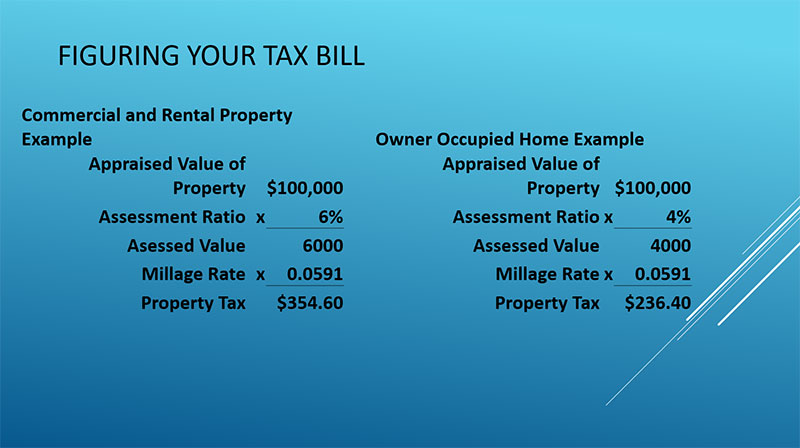

First, what is millage? It’s just a fancy term for the way property tax rates are expressed and is written as a percentage number. A mil is equal to $1 of tax per $1000 in assessed value.

Above is the breakdown for the number that the SC Association of Counties is using for its comparisons in defining “County Base Millage Rate.” In 2022, Greenville County’s base millage rate was 59 mils: County General Fund: .03930, Greenville Tech: .00500, Library: .00800, Art Museum: .00140, Debt: .00040, Charity Hospitalization: .00230, Certificates of Participation: .00100, and Solid Waste: .00170. This does not include any other entity like municipalities, school boards, fire districts, sewer, etc. This number does include Greenville Tech and the Library because that is what the SC Association of Counties included. We all pay this base amount no matter where we live. In my writings, this is the number and definition I have stuck to when comparing us with other counties.

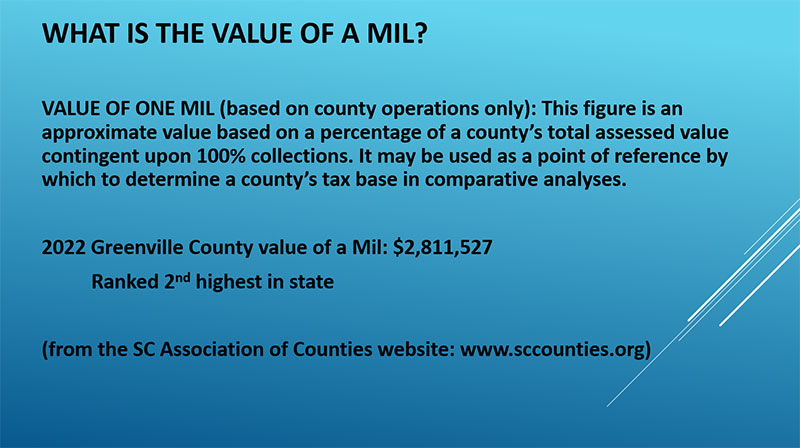

As seen above, the value of one mil is an approximate value based on a percentage of the county’s total assessed value contingent upon 100% of the tax being collected. The value of a mil is important because it shows where we rank in the state as compared to the other counties based on the assessment of our properties. It is very important to note that our county tax assessor’s office sets the taxable assessed value on each property. That may or may not be the market rate.

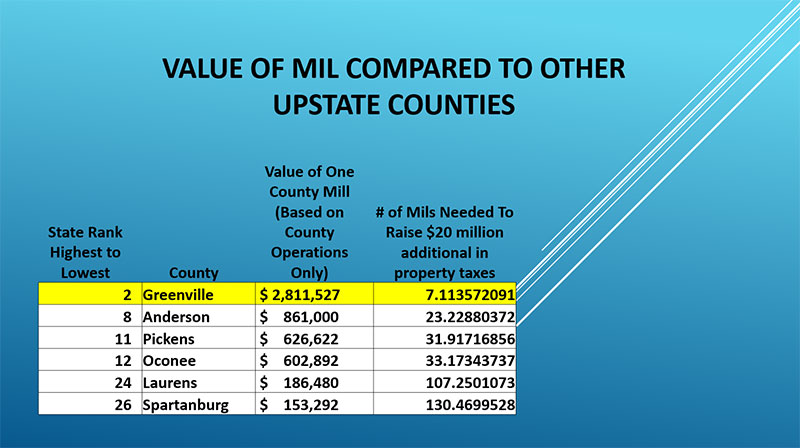

For 2022, Greenville County’s value of a mil is $2,811,527. For 2022, we are ranked second behind Charleston County which has a value of a mil of $4.7 million. Horry County is 3rd in the state at $2.7 million.

In Greenville County, we have a lower millage rate but are paying more in taxes because our assessed value is higher. All our neighboring counties have a much lower value of a mil. This means a house appraised at $250,000 in Greenville would be considered less house than one appraised at $250,000 in another upstate county. To raise $20 million, the approximate amount our County Council is seeking to raise, Anderson would need to increase their millage by 23, Pickens by 31, Oconee by 33, Laurens by 107, and Spartanburg by 130. So, when our leaders try to make it sound like we are low in our taxes compared to others, they are not telling the full story. Yes, our millage is lower, but our properties are assessed considerably higher than they would be in other counties.

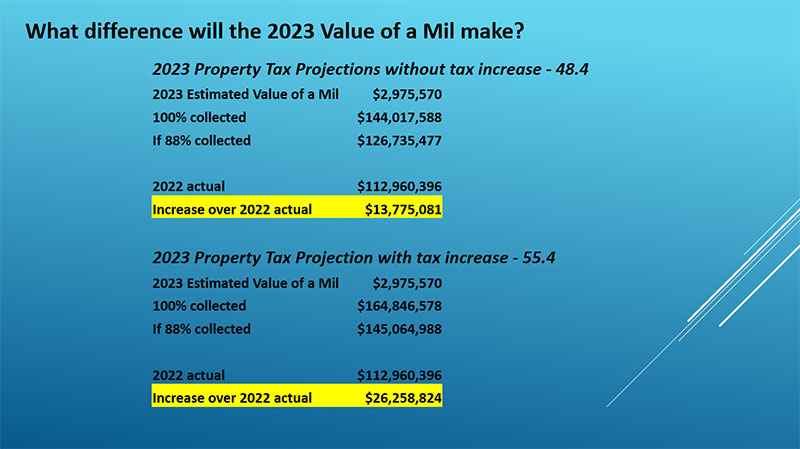

Over this past weekend, I was given a piece of paper by someone not on County Council. I had not seen this information before. It was something that Joe Kernell gave to the Council but was never made public. On it, Mr. Kernell gives the 2023 value of a mil for Greenville County as $2,975,570. This number is dated April 4, 2023, long before our real property tax bills will be printed. In the budget, he bases his estimates on collecting 88% of the taxes due the County. Based on this new value of a mil, this means that without the tax increase, the County’s property tax revenue was estimated to go up to $126,735,477. This is an increase of $13,775,081 over the 2022 collections. With the tax increase, the revenue is estimated to go up to $145,064,988 which is an increase of $26,258,824.

To figure your property tax: the taxable appraised value is multiplied by the assessment ratio. That amount is then multiplied by the millage rate. On the County’s website, there is a table for 2022 that shows each tax district and the total millage for that district combining all taxing entities.

I listened to the budget workshop and started reading the budget. Inordinately high budget increases started jumping out at me and when I would try to find out why, there weren’t any concrete answers. I learned we don’t do zero-based budgeting. We also don’t have a true budget, not even really a spending bill as Joe Kernell is authorized to transfer money from account to account however and whenever he desires without asking the County Council thereby changing the budget. An example of this is the time when he put a $1 million crane purchase in the budget under roads. The money for a new crane was in there to reserve the money for future use. No one is sure whatever really happened to the money. He actually referred to the crane money at this year’s budget workshop. Then I looked at the Auditor’s report for 2022 and even more questions arose.

I also took the expenses that are listed on the County’s website for both the new buildings and the Halton Road building and put them in a spreadsheet. Talk about eye-opening. Here is where I discovered we spent just under $60,000 on water bottles, coffee cups, and coffee tumblers alone. This exercise also showed how sloppy things are entered into the website. Whether it was accidental or intentional so we wouldn’t know the whole truth, I don’t know, but in an organization that size there is no excuse for the sloppiness.

A lot of my writing came in direct response to things that were said on the news and in meetings by our county officials.

I’ve had multiple people reach out to me in private to give me information or to tell me where to look. I don’t reveal my sources.

There remains a pile of questions to ask and information to sort through. There are still all the questions I’ve asked that need to be answered.

This same research really needs to be done for each governing entity within our county.

Yes, we lost the vote on the property taxes, the battle. But we are in a war that we have to continue to fight and win. Now is the time to start working on replacing these people who voted against the taxpayer. Our county government must become more open. We must put pressure on them to put more things online. They must stop giving money away to special interests. Just because it sounds good doesn’t mean we the taxpayer should be paying for it. You can look for the roads to come up again soon in the form of another tax – probably either a sales tax or an additional road maintenance fee. You can also look for a discussion on the Triumph Soccer Stadium. Is the money hidden in the budget? Probably, but where? Only Joe Kernell knows for sure. We must not continue to allow the citizens to have a short memory. We must continually remind them. My goal is to continue to write on issues and keep reminding people so that we don’t forget before the local election cycle starts next year.

--------------------------

You can watch the presentation as given by Michelle Shuman below ...

--------------------------

Resources recommended by Michelle Shuman:

Greenville County Website: www.greenvillecounty.org

The South Carolina Association of Counties website: www.sccounties.org