President Biden’s 2024 State of the Union Address presented a vision of higher taxes for American businesses and high earners combined with carveouts, credits, and more complex rules for taxpayers at all income levels. On Monday, the president released his proposed budget for fiscal year 2025 outlining how the White House would implement the president’s tax vision, amounting to a gross tax hike exceeding $5.1 trillion over 10 years.

Rather than aiming for a simpler tax code that broadly encourages investment, saving, and work in the United States, the president has promised higher taxes that would decrease economic output and incomes, reduce U.S. competitiveness, and further complicate the tax code.

While the Biden budget claims to reduce deficits as a share of the economy over the next decade, that claim is based on several unrealistic assumptions, including:

- No extension of the individual and estate tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) that are set to expire at the end of 2025, despite signaling interest in extending the tax cuts for people earning under $400,000, which would cost at least $1.4 trillion over the 10-year budget window

- No extension of the administration’s proposed expansion of the child tax credit beyond 2025, which would cost more than $1 trillion over the budget window

- Economic growth well in excess of what is forecast by the Congressional Budget Office (CBO)

The FY 2025 Biden budget includes the following major changes, beginning in 2024 unless otherwise noted:

Major Business Tax Provisions in Biden Budget

- Increase the corporate tax rate from 21 percent to 28 percent

- Increase the corporate alternative minimum tax (CAMT) on book income tax rate from 15 percent to 21 percent

- Disallow deductions for employee compensation above $1 million

- Quadruple the stock buyback tax from 1 percent to 4 percent

- Make permanent the excess business loss limitation for pass-through businesses

- Eliminate the foreign-derived intangible deduction (FDII) and replace it with unspecified research & development (R&D) incentives

- Repeal the base erosion and anti-abuse tax (BEAT) and replace it with an undertaxed profits rule (UTPR) consistent with the OECD/G20 global minimum tax model rules

- Raise taxes on fossil fuel companies and oil extraction

Major Individual, Capital Gains, and Estate Tax Provisions in Biden Budget

- Expand the base of the net investment income tax (NIIT) to include nonpassive business income and increase the rates for the NIIT and the additional Medicare tax to reach 5 percent on income above $400,000

- Increase top individual income tax rate to 39.6 percent on income above $400,000 for single filers and $450,000 for joint filers

- Tax long-term capital gains and qualified dividends at ordinary income tax rates for taxable income above $1 million and tax unrealized capital gains at death above a $5 million exemption ($10 million for joint filers)

- Create a 25 percent “billionaire minimum tax” to tax unrealized capital gains of high-net-worth taxpayers

- Limit retirement account contributions for high-income taxpayers with large individual retirement account (IRA) balances

- Tax carried interest as ordinary income for those earning over $400,000

- Limit 1031 like-kind exchanges to $500,000 in gains

- Tighten estate and generation-skipping tax (GST) rules

- Tighten tax rules for digital assets, including cryptocurrency, and impose a new 30 percent excise tax on electricity costs associated with digital asset mining

Major Tax Credit Provisions in Biden Budget

- Extend the American Rescue Plan Act (ARPA) child tax credit (CTC) through 2025 and make the CTC fully refundable on a permanent basis (effective 2023)

- Permanently extend the ARPA earned income tax credit (EITC) expansion for workers without qualifying children (effective 2023)

- Permanently extend the ARPA premium tax credits expansion

- Make permanent the new markets housing tax credit and provide new tax credits for home buying and selling

Additional Major Provisions in Biden Budget

- Expand federal rules on drug pricing provisions

- Make permanent the exclusion of student loan forgiveness from income tax

Note: In a forthcoming update, we will estimate the economic, revenue, and distributional effects of the major tax proposals in the FY 2025 budget.

The tax changes Biden proposes fall under three main categories: additional taxes on high earners, higher taxes on U.S. businesses—including increasing taxes that Biden enacted with the Inflation Reduction Act (IRA)—and more tax credits for a variety of taxpayers and activities. The combination of policies would move the tax code further away from simplicity, transparency, and neutrality.

President Biden reintroduced his proposal to raise the effective tax rates paid by households with net worth over $100 million. The proposal requires these households to pay a 25 percent minimum tax rate on an expanded definition of income that includes unrealized capital gains. This means these households would pay tax on capital gains even if the underlying asset has not yet been sold, operating as a prepayment for future capital gains tax liability.

The billionaire minimum tax, as it is commonly known, would increase the complexity of the tax code by using a non-traditional and difficult-to-measure definition of income. It would require formulaic rules for valuing different types of assets, payment periods that vary by asset type, and a separate tax system to deal with illiquid assets. This tax design goes well beyond international norms, where capital gains are taxed when realized and at lower rates than the U.S. in many cases.

Aiming to address Medicare’s growing budgetary shortfalls, the president would raise the hospital insurance (HI) payroll tax for those earning over $400,000 from 0.9 percent to 2.1 percent. The net investment income tax (NIIT), a 3.8 percent tax on passive investment income for those earning over $200,000 (single) or $250,000 (joint), would be expanded to include active business income. This change would raise top tax rates on labor and business income while not doing enough to put entitlements on a path toward solvency.

President Biden also committed to preserving the additional funding appropriated to the Internal Revenue Service (IRS) as part of the Inflation Reduction Act. Biden argues this would help raise revenue from higher earners who evade taxes and would also improve taxpayer services. Much of this new revenue may take time to appear as the IRS trains new staff and spends time identifying evasion and enforcing the tax law. However, the other components of Biden’s tax plan will push the code in a more complex direction, making the job of the IRS to enforce the law more difficult.

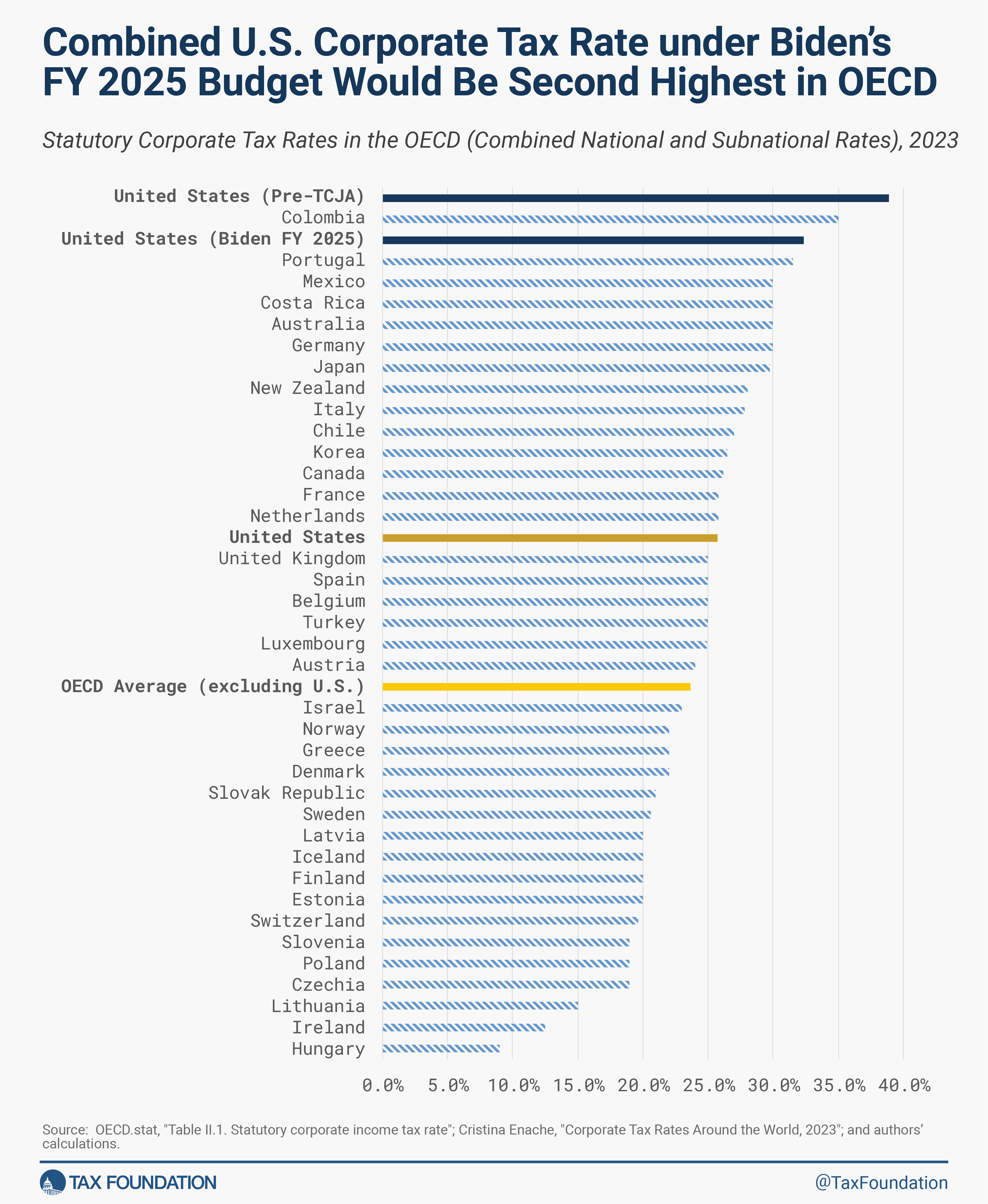

President Biden proposed to raise the corporate income tax rate from 21 percent to 28 percent, a policy he has pushed for since the 2020 campaign. The corporate income tax is the most harmful tax for economic growth and its many problems have led countries around the world to reduce corporate tax rates considerably over the last 40 years to an average of about 23 percent as of 2023. The U.S. had the highest corporate tax rate in the OECD prior to the TCJA, which lowered the U.S. corporate tax rate to be roughly average among OECD countries. Recent studies have determined that lowering the corporate tax rate significantly boosted investment in the United States, a long-term process that continues to yield economic benefits, including gains in workers’ wages.

Raising the corporate tax rate from the current 21 percent to 28 percent, combined with the average state-level corporate tax rate, would give the U.S. the second-highest combined corporate tax rate in the OECD, significantly worsening the competitive position of U.S. businesses and reducing prospects for business investment and workers.

On top of a higher statutory corporate tax rate, Biden has proposed increasing the rate of the new corporate alternative minimum tax on book income from 15 percent to 21 percent. The tax was enacted in August 2022 as part of the IRA and scheduled to go into effect starting in 2023, but the IRS postponed its implementation because of the complexity of enforcing it. Taxpayers are still awaiting guidance on several significant questions related to the CAMT, and it remains questionable whether the tax is even feasible. It has certainly failed thus far as an effective minimum tax.

Biden also proposed quadrupling the IRA’s 1 percent excise tax on stock buybacks. Stock buybacks are one of the ways businesses return value to their shareholders. Companies can return earnings to shareholders by issuing dividends (namely cash payments) or with stock buybacks (purchasing shares of their own company). As much as 95 percent of the money returned to shareholders from stock buybacks subsequently gets reinvested in other public companies. Quadrupling the tax rate would likely discourage firms from pursuing stock buybacks, potentially tilting toward more dividend issuances instead, and could discourage investment.

As a new proposal, Biden would expand the cap on deductions for employee compensation above $1 million (Section 162m). The cap currently applies to the CEO, CFO, and the next three highest-paid employees of a corporation, and due to ARPA is already scheduled to expand to the next five additional highest-paid employees beginning after 2026.

Biden’s proposal would expand the cap to cover all employees, raising the cost of compensating employees and making it costlier for corporations to attract and retain top talent. It would mean both the corporate and individual top tax rates would apply to wages, resulting in top tax rates of 70 percent or more including state taxes. If the $1 million threshold is not indexed to inflation, over time the tax would hit more than just the C-suite.

Biden has called for several proposals to subsidize home purchases and boost the low-income housing tax credit, including a tax credit worth $5,000 per year for two years for middle-class, first-time homebuyers. The president would also offer a one-year tax credit worth up to $10,000 for middle-class households who sell a starter home to help improve starter home availability. Finally, the president proposes to provide up to $25,000 in down payment assistance for first-generation homebuyers.

Boosting demand through subsidies is likely to cause housing prices to increase further. What is needed is a greater supply of housing, which would be best accomplished at the state and local level by reforming zoning rules and at the federal level by reforming tax depreciation rules for residential structures.

For developers, the president would expand the low-income housing tax credit (LIHTC) and create a new neighborhood homes tax credit to build or renovate affordable houses. This approach would be an inefficient way to build new homes as the existing LIHTC is expensive for the homes produced, with much of the credit value going to developers and financing agencies.

President Biden would renew the expanded child tax credit from the 2021 American Rescue Plan Act, which would raise the CTC value from $2,000 to a maximum value of $3,600 while removing work and income requirements. This CTC expansion would have major fiscal costs totaling over $1 trillion over 10 years above the current-policy CTC. If we include the underlying CTC expansion from the Tax Cuts and Jobs Act that expires at the end of 2025, the cost approaches $2 trillion over 10 years.

In addition to the CTC expansion, the president would expand the EITC and make permanent the expanded Affordable Care Act (ACA) premium tax credits that are scheduled to expire at the end of 2025.

Finally, the president recommitted to not raising taxes on those earning under $400,000, arguing that he would fully pay for expiring TCJA individual tax changes with “additional reforms” that would further raise taxes on high earners and businesses. These unspecified reforms would need to total at least $1.4 trillion to cover TCJA extension for people earning under $400,000.

The president’s tax policy proposals as outlined in the State of the Union address would make the tax code more complicated, unstable, and anti-growth, while also expanding the amount of spending in the tax code for a variety of policy goals not related to revenue collection.

The White House estimates the FY 2025 Biden budget would reduce the budget deficit by $3.2 trillion over 10 years. However, this estimate does not include the cost of their intended extension of the TCJA tax cuts for those earning less than $400,000 or for the proposed expanded CTC post-2025. These tax changes alone would wipe out most of the touted deficit reduction.

The Biden budget also assumes an unrealistically high rate of growth in the economy, especially considering the large tax increases proposed on businesses and high earners that will slow growth. The budget assumes real GDP will grow at 2.2 percent annually in the last 5 years of the budget window, while the CBO assumes real GDP will grow about 1.9 percent annually over this period.

In sum, President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the U.S. in a distinctly uncompetitive international position and threaten the health of the U.S. economy. The Biden budget ignores or makes unrealistic assumptions about the fiscal cost of major proposals as well as economic growth under this plan, concealing what is likely to be a substantial cost borne by American workers and taxpayers.