- Revisiting the Great Work of Medical Missionary Dr. Anne Livingston in Haiti

- Dick Cheney Was a Great Boss

- "I Beat Hitler!"

- Christmas Season in Western North Carolina

- 2026 US Senate Race in North Carolina

- The Fall of Man: John Calvin, Leibniz, and Deeper Truths

- Time of Reassessment America

- Has the Bethlehem Star Mystery Been Unveiled?

- Appeals Court Refuses to Dismiss Greenville County Republican Chairman’s Contempt Case

- The America That Once Was (A Christmas Memory)

- Is a Self-Proclaimed Drag Queen Performer Serving in a Leading Moral Arc Role at a Greenville Children’s Production of Annie?

- Project Ukraine and Ukrainian/CIA Intelligence

- The Busan Trade Summit between U.S. and China

- Merry Christmas from Times Examiner

- Republican Women's Club Hosts Freedom Caucus Members

News

Far Left Democrat Judge Coming to SC?

- Details

- By SC Freedom Caucus

Another Black Eye on the Republican Supermajority

The way South Carolina selects judges is rife with corruption and conflicts of interests—lawyer legislators handpick the very judges they argue cases in front of and ballots are counted in secret by legislators to avoid on the record votes.

Sadly, time and time again, those judges are liberals who legislate from the bench despite the fact that Republicans hold supermajorities in both Chambers. Even more surprisingly, these judges are often spouses, immediate family members, or law partners of sitting legislators—or even former legislators themselves.

So who is the establishment’s top pic for judge this time? Former Democrat lawyer-legislator and former Democratic Party nominee for governor James Smith.

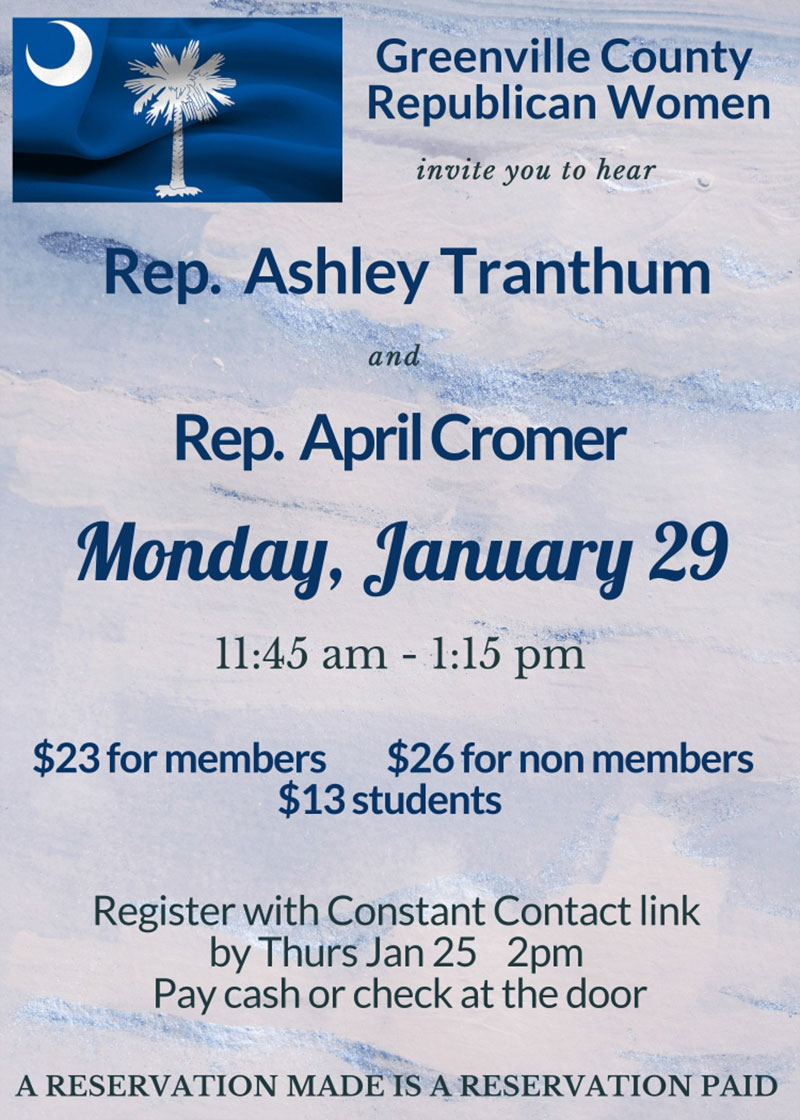

GCRW's First Meeting of 2024 with Rep. Ashley Tranthum and Rep. April Cromer

- Details

- By GCRW

State Corporate Income Tax Rates and Brackets, 2024

- Details

- By Tax Foundation

Key Findings

- Forty-four states levy a corporate income tax. Top rates range from a 2.5 percent flat rate in North Carolina to a 9.8 percent top marginal rate in Minnesota.

- Four states—Alaska, Illinois, Minnesota, and New Jersey—levy top marginal corporate income tax rates of 9 percent or higher.

- Twelve states—Arizona, Arkansas, Colorado, Indiana, Kentucky, Mississippi, Missouri, North Carolina, North Dakota, Oklahoma, South Carolina, and Utah—have top rates at or below 5 percent.

- Nevada, Ohio, Texas, and Washington impose gross receipts taxes instead of corporate income taxes. Delaware, Oregon, and Tennessee impose gross receipts taxes in addition to their corporate income taxes. Some localities in Pennsylvania, Virginia, and West Virginia likewise impose gross receipts taxes, which are generally understood to be more economically harmful than corporate income taxes.

- South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts tax.

Corporate income taxes are levied in 44 states. Though often thought of as a major tax type, corporate income taxes accounted for only 7.07 percent of state tax collections and 3.32 percent of state general revenue in fiscal year (FY) 2021. And while these figures are not high, they represent a substantial increase over prior years. Corporate income taxes accounted for 2.27 percent of general revenue in FY 2020, which is more in line with historical norms.

Bridge, Road Work in SC Still Moving Slowly with Gas-tax-hike Money

- Details

- By Rick Brundrett - The Nerve

In recently announcing his proposed nearly $41 billion total state budget for fiscal 2025, Gov. Henry McMaster recommended using a projected $500 million school-fund surplus for emergency bridge replacement and repairs.

“Many of these bridges are 60, 70 and even in excess of 80 years old and are crumbling before our eyes each day,” McMaster said in a Jan. 5 press release. “Too many have been closed, while others are in such a state of disrepair that the required restrictions render them useless for commercial trucking, school buses, or fire trucks needed to serve our state’s increasing population.”

GOP Experts Warn Candidates to Stop Treating Abortion ‘Like a Hot Stove’ They Won’t Touch

- Details

- By Suzanne Bowdey - The Washington Stand

Nobody likes a wimp — and on the issue of abortion, the Republican Party has plenty of them. After the Dobbs ruling put the issue back in legislators’ hands, a shocking number of GOP candidates spent the 2022 and 2023 elections cowering in the collective corner, hoping voters would take their silence as confirmation that they had a reasonable position on life (despite the Democrats’ 24/7 ads to the contrary). Now, staring down a high-stakes November where this issue has the potential to upend all of the GOP’s momentum, more voices are urging the party to get off the sidelines and fight.

Dancing on Roe's Grave: Nearly 140 Abortion Clinics Closed Since its Overturn, More Victories to Come

- Details

- By Operation Rescue

WASHINGTON -- As the pro-life movement victoriously marks the 50th National March for Life, abortion clinic closures are celebrated around the nation. Millions of courageous and caring individuals and groups have gathered and marched in solidarity for the rights of preborn children in Washington, D.C., for decades.

This year's national March for Life is being held three days prior to the anniversary of that horrendously unjust decision and less than two years after the anniversary of the day it was finally overturned – June 24, 2022. For pro-lifers, the celebration of that day continues, but the fight to protect innocent, preborn children also rages on.

Mountain Gateway Addresses Recent Allegations from the Nicaraguan Government Against Three U.S. Citizens and 11 Nicaraguan Mountain Gateway Pastors

- Details

- By Mountain Gateway

DRIPPING SPRINGS, Texas -- On Jan. 17, 2024, Mountain Gateway, functioning in Nicaragua as Puerta de la Montaña, was made aware that the Attorney General of Nicaragua is moving forward in pursuing charges against three U.S. citizens associated with Mountain Gateway (Jon Britton Hancock, Jacob Britton Hancock, and Cassandra Mae Hancock) and 11 Mountain Gateway Nicaraguan pastors.

The allegations are for money laundering and organized crime. Mountain Gateway would like to publicly state it denies these allegations, and it is saddened by this situation. Mountain Gateway has diligently followed all legal requirements in the U.S. and Nicaragua that apply to non-profit and faith-based organizations.

- Americans Win Battle to Protect our Natural Assets — Our Land, Water, and Air

- SC House Passes Bill to Ban Childhood Gender Transitions!

- Human Life International at March for Life to Open Eyes to America's Role in Worldwide Abortion

- He Blew the Whistle. Now the Feds Are Punishing Him for It.

- New Documentary Warns American Church of Complacency/Complicitness on Par with 1930's Pre-Holocaust German Church

- BJU Bruins Host 52nd High School Invitational Basketball Tournament

- Eagle Forum Applauds Appeals Court Decision to Allow Alabama to Protect Vulnerable Children